ASC Strategic Plan

Message from the Chair

June 2025Alberta’s industries, and the innovative and entrepreneurial spirit that makes them grow, are key drivers fuelling our capital market, which in turn plays such an important role in Canada’s national economy.

A CHANGING RELATIONSHIP BRINGS NEW OPPORTUNITY

For generations, Alberta and Canada have enjoyed a strong, mutually beneficial relationship with the U.S. These bonds fostered economic growth, stability and investment opportunities on both sides of the border.

Today, we are forced to confront unsettling times, with ever-changing geopolitical dynamics and technological advancements that influence both Canadian and international capital markets. The challenges posed by our closest ally have spurred new strategic thinking to safeguard our economic interests.While I agree that this uncertainty is challenging, I also believe these circumstances offer opportunities for Canada to innovate, reconsider our competitive advantage, diversify our economy, strengthen our global relationships and grow our capital markets for the long term.

A THREE-YEAR PLAN FOR STABILITY AND GROWTH

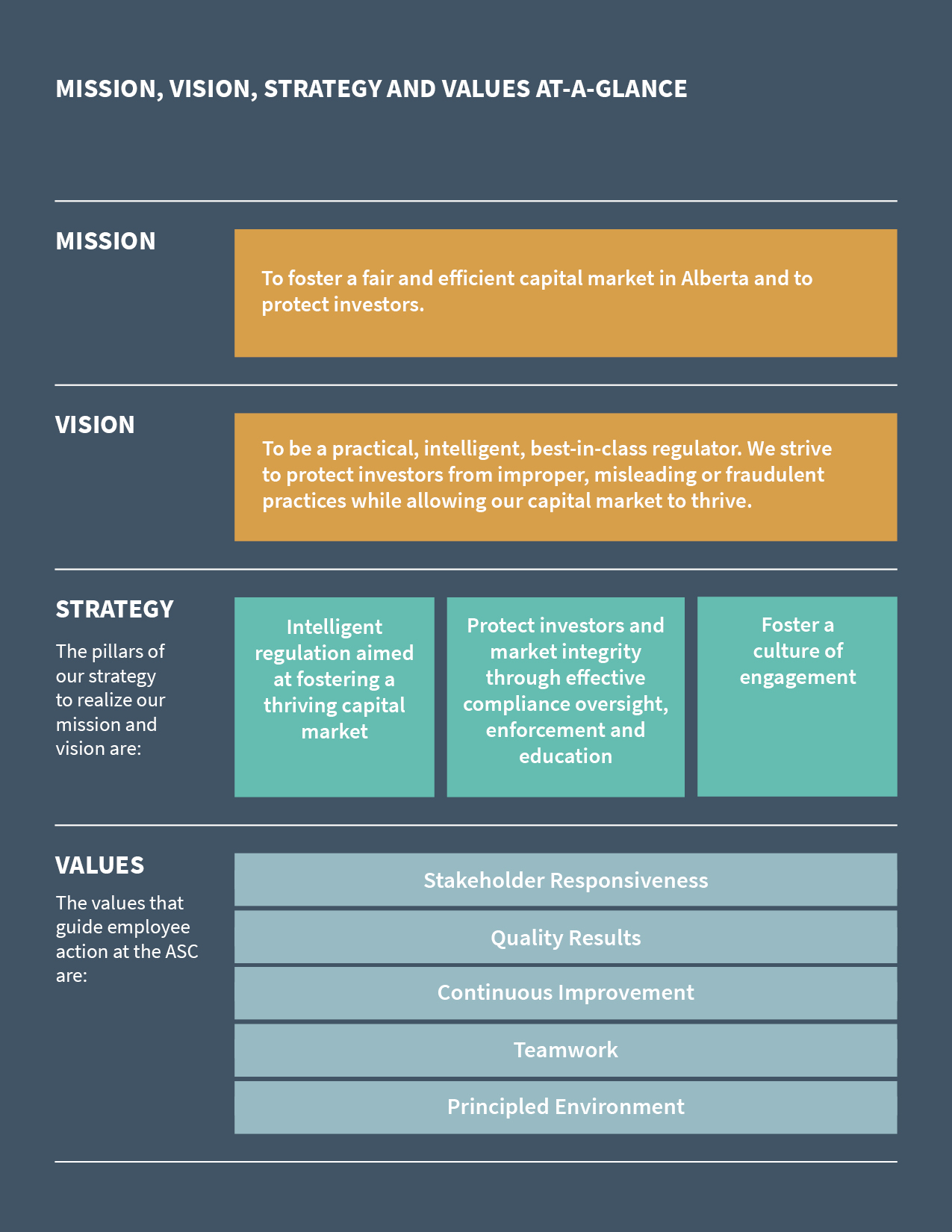

The Alberta Securities Commission (ASC) is a practical, focused and collaborative regulatory agency. We are dedicated to protecting investors and fostering a fair and efficient capital market in Alberta that encourages economic growth, resilience and market integrity. The ASC continues to monitor and consider fast-moving international forces to assess potential implications for our market and we remain committed to providing practical and appropriate regulatory solutions.

Given the current economic environment, the ASC’s three-year strategy is more important than ever. I strongly believe that our plan will guide us as we navigate these uncertain times, and that it will also enable us to be resilient.

Fiscal 2025 (F2025) ended on March 31, 2025. It was the second year of the ASC’s current three-year strategic plan. F2025 was marked by advancements in responsible innovation and significant stakeholder engagement, reinforcing the ASC’s position as a relevant and practical regulator that is responsive to market participants and emerging trends. We are now executing the final year of our current three-year strategy (F2026), and in the process of developing our next three-year strategy.

WORKING TOWARDS COMMON GOALS: ASC AND THE CSA

Our regulatory work is a close collaboration with fellow provincial and territorial securities regulators from across our vast and diverse nation, through the Canadian Securities Administrators (CSA). The CSA brings us together to share ideas and work to design and implement policy and regulations that are consistent to support the smooth operation of Canada’s securities industry, and to disrupt bad actors and hold them accountable. I am proud to continue to Chair the CSA, and that the ASC has a strong voice at the table.

I believe that intelligent regulation and investor protection provide all market participants with the structure, confidence and clarity needed to move forward and help our country compete and prosper.

As previously noted, the global economic landscape has changed rapidly and significantly. After much consideration, the CSA paused its work on the development of a new mandatory climate-related disclosure rule and amendments to the existing diversity-related disclosure requirements. This pause aims to reduce mandatory regulatory burden to support the international competitiveness of Canada’s capital markets while providing flexibility for the CSA to revisit the projects in the future.

The CSA is now focusing on introducing measures to reduce regulatory burden and support the competitiveness of Canada’s capital markets without sacrificing investor protection. In April, we introduced three blanket orders to support market participants that choose to go public, maintain a listing, and contribute to capital formation in Canada. This is the start of actions the CSA is taking to make it easier and more cost-effective for businesses to raise capital and grow in Canada.

FINHUB, AI AND CRYPTO: FOSTERING INNOVATION

Over the last year, the ASC and the CSA have continued to evolve our support for the technology sector, fostering innovation in Canada’s capital markets. The ASC is the Chair of the CSA’s Financial Innovation Hub (FinHub), an initiative intended to support innovation in the Canadian capital markets, benefiting investors and market participants. This year, as part of the FinHub, we were pleased to launch the CSA Collaboratory – a dedicated testing environment for regulators to engage more intensively with both established market participants and innovative businesses pioneering new tools and business practices.

The first test in the Collaboratory explores the theme of data portability as it relates to electronic know-your-client solutions (eKYC). Those that work within the Collaboratory are looking forward to subsequent tests that will assess innovations under real-world conditions in support of Canada’s evolving capital markets.

As artificial intelligence (AI) evolves, the CSA took the opportunity to engage market participants on how securities legislation applies to AI systems. Input from these stakeholders will play a critical role in informing future initiatives to refine the regulatory framework applicable to the use of AI systems in capital markets.

This year, we made additional strides towards a coordinated regulatory regime for crypto assets and crypto asset trading platforms (CTPs) by providing guidance on the securities law requirements that apply to CTPs, and by clarifying the CSA’s approach to value-referenced crypto assets (VRCAs).

TOWARDS A STRONGER START-UP ECONOMY

The ASC recognizes the value of a strong and vibrant start-up and entrepreneurial community in our province. To further demonstrate our commitment to growth in this area, the ASC has entered into a partnership with Platform Calgary and Edmonton Unlimited, each of whom support Alberta start-ups with interactive learning environments, mentorship, education and resources. We’re excited to see how our joint programming in Calgary and Edmonton will fill the private market knowledge gap among first-time founders and investors.

ENFORCEMENT DEMANDS CONSTANT VIGILANCE

The ASC’s enforcement efforts are a critical component of our investor protection mandate. Accordingly, the ASC continues to look for new ways to detect, disrupt and deter misconduct, and to hold offenders accountable. We concluded several enforcement files in F2025, most notably Ronald James Aitkens, who was sentenced to four years in jail after fraudulently diverting at least $10.7 million of $35 million raised from nearly 1,500 investors to his personal companies. Aitkens – a noted repeat offender – had previously failed to appear in court for sentencing after being found guilty of fraud and making false or misleading statements in an offering memorandum contrary to the Alberta Securities Act. A Canada-wide warrant was issued for his arrest after it was believed he had fled to the U.S. Thanks to strong collaboration between law enforcement agencies on both sides of the border, he was located in Montana in August 2024 and returned to Canada to face sentencing

In September 2024, the ASC launched the ScamShield: Investor Protection Challenge, in partnership with the Edmonton Police Foundation and the Edmonton Police Service, to address the significant harm posed by online investment fraud. The Challenge received more than 30 submissions from around the globe and two concepts were chosen to move forward to the next stage. Both are now in development and we plan to share more about these tools in the coming months. Once vetted and launched, they will complement and enhance the full range of free and unbiased investor resources available on our CheckFirst.ca website.

ENGAGEMENT INFORMS OUR THINKING

In addition to seeking comment and feedback on proposed rules and policies, the ASC also strives to engage with market participants at numerous in-person and virtual events throughout the year.

In December, we gathered an extraordinary group of speakers and panellists for our eighth annual ASC Connect conference. This year’s theme of “Fostering a thriving Alberta market” focused discussion on innovation and its critical role in the diversification of Alberta’s economy; the implications of changes to capital formation and investor participation in our private and public markets; and the impact of AI and machine learning technologies on capital markets.

A TIME TO EXPAND OUR HORIZONS

As we move into the last year of our three-year strategic plan, I believe the ASC’s principles of intelligent regulation, effective compliance oversight, enforcement and education, and a culture of engagement, will continue to guide us through difficult times ahead.

Despite all that is unfolding around us, I know for certain that Alberta remains a crucial part of Canada and that our capital market is important. Alberta’s entrepreneurial and hard-working voice is essential as Canada considers how to move forward.

We now find ourselves embarking on a new path that will require us to take global realities into consideration – a path that demands we consider alternative ways of fulfilling our mandate. By working within the CSA, we can help strengthen our Canadian markets and support a brighter future for our country.

Additionally, each year we monitor and summarize our progress through our Annual Report. Stay tuned for our next Annual Report, coming in June 2026.

With kind regards,

Stan Magidson, KC

Chair and Chief Executive Officer

Pillar One: Intelligent regulation aimed at fostering a thriving capital market

Intelligently regulating the Alberta capital market is what we do. We strive to ensure that our regulatory regime is appropriate to the needs of our market, facilitates capital growth and promotes strong investor protection while not unduly burdening issuers and other market participants.

Themes:

Reduce regulatory burden

All new laws, rules, policies and projects will be assessed to determine whether they add value, and to ensure there is due consideration of the costs of the regulation, compared to the benefits for Alberta’s unique capital market. We will also embrace opportunities to revise regulatory instruments to achieve greater clarity for the intended audience, and develop meaningful guidance and case studies to support enhanced understanding for market participants. In support of Alberta capital market innovation and development, we will monitor the use of exemptions and use a multi-divisional team to test automation and the use of technology for regulatory, supervisory and oversight purposes.

Address emerging and evolving regulatory frontiers

To keep pace with the rapidly changing Alberta marketplace and constantly evolving securities industry, we are continuing our work in a number of areas, including:

- Systemic risk: The ASC plays an important role in the CSA Standing Committee on Systemic Risk, as well as the Heads of Agencies (HoA) and its Systemic Risk Surveillance Committee. The ASC also engages with the Financial Stability Board and the International Organization of Securities Commissions (IOSCO) to actively monitor, analyze and consider how best to address risks that could impact markets nationally and internationally.

- Derivatives markets: We will continue to implement a practical derivatives framework including the necessary compliance and surveillance tools required to ensure a practical and effective regime. We will also be a leader in the CSA respecting oversight of energy commodity derivatives and monitor carbon offset markets, providing appropriate regulation.

- Environment, social and governance: The ASC will continue to play a leadership role in relevant environmental, social and governance related policy discussions.

- All things energy: We will leverage our existing oil & gas expertise and continue to build out our abilities in “all things energy” (e.g. cleantech, carbon capture, utilization and storage technology, lithium, helium and hydrogen production, and renewable energy).

- Financial technology: We will continue to monitor technological innovation in the financial marketplace and its intersection with securities laws, and develop an appropriate regulatory response. This includes conducting research to better understand “do-it-yourself” investing, gamification and the impact of social media and advancing regulatory initiatives as necessary, and addressing crypto and digital asset regulation.

- Market structure: We will continue to participate in CSA projects related to market structure.

Leverage technology

Technology plays an important role across industries, including financial services. The ASC has a digital plan to improve our use of existing technologies and incorporate new technologies to increase efficiency, expand the use of analytics and support opportunities to use evidence-based decision making.

Question the regulatory status quo

As regulators we must adapt to changing market conditions while providing a level of stability upon which market participants can depend. We will continue to work with the Canadian Securities Administrators (CSA) to be harmonized to the greatest extent possible, while still remaining a strong advocate for the unique needs of market participants in Alberta. We will also continually monitor and research alternatives, scanning both the domestic and international regulatory environments to inform our position and policies on a variety of securities matters.

Engage with other regulators

While our primary responsibility is to oversee the Alberta capital market, we must do so cooperatively and mindfully of regulations that govern other jurisdictions both nationally and internationally. With so many new developments, including new financial instruments such as crypto assets, securities regulation is increasingly complex and much of it occurs in an international arena. As such, we will continue to actively engage with the CSA, the HoA, the North American Securities Administrators Association (NASAA), IOSCO, and other national and international bodies, to stay informed, add value to the broader development of regulatory standards through our participation, and engage in areas that are critical to our being an effective, practical and intelligent regulator.

Support diversification of Alberta’s economy

In an effort to support the resiliency and integrity of our capital market, the ASC will continue to explore ways to support the province’s efforts to expand the financial sector in Alberta. Additionally, we will support the province’s efforts to diversify and build Alberta’s economy.

Pillar Two: Protect investors and market integrity through effective compliance oversight, enforcement and education

The ASC monitors current market activity, anticipates future challenges, collaborates with other organizations and acts decisively in order to promote confidence, inform and protect investors and support market integrity.

Themes:

Detect and disrupt misconduct, and hold offenders accountable

As securities fraud and misconduct becomes ever more complex, crosses borders and incorporates new technologies to mislead investors and escape detection, it is imperative that we work collaboratively and have access to the right information, expertise, processes and technology to detect ‘bad actors’, analyze data and evidence, remove financial incentives for misconduct, disrupt securities misconduct in response to trends and minimize the threat posed by recidivists. As part of this we will also continue outreach with partner agencies to share information and collaborate, work collaboratively with other regulators and seek support of market participants to detect securities misconduct.

Ensure effective compliance oversight

Delivering effective compliance oversight is central to the ASC’s regulatory responsibilities. We will continue to make any necessary changes to ensure that we are optimally positioned to respond to the needs of our market. That includes proactively identifying emerging issues, trends, and risks in securities and derivatives market structures, as well as associated trading, dealing and advising.

Priority initiatives will include the continued operationalization of the client focused reforms and playing a meaningful role in the oversight of OBSI, including implementing binding decision making. We will also continue to refine our review process to increase personal interaction with registrants, pursue technology to assist with effective compliance oversight, monitor and analyze electronic media used in stock promotions and participate in a number of CSA working groups and projects designed to protect investors.

Enhance investor education efforts to reach a broader audience

Investment literacy is a life skill that helps investors grow and protect their hard-earned money. With longer life spans and fewer companies offering defined-benefit pensions, it is increasingly important that Canadians become knowledgeable about how to safely invest for their future.

The ASC will continue its efforts to broaden investment literacy and enhance investor protection in Alberta. We plan to continue to enhance our consumer website, CheckFirst.ca, and our social media channels, expanding tools and resources and empowering all Albertans to learn about investing. We will also actively expand our investor education outreach through partnerships and continue to conduct timely and frequent campaigns, leveraging data collected from our compliance and enforcement activities whenever possible. We are also working to reach, engage and inform new Canadians, and Indigenous communities within Alberta.

Increase direct interaction with market constituents to more effectively communicate regulatory objectives

The ASC will continue to work with market participants to advance their understanding of the regulatory regime, including developing and providing plain language web content and sharing regular, timely and meaningful information. We will position the ASC as the regulator of choice for new market participants seeking to enter the Canadian market.

Pillar Three: Foster a culture of engagement

The collective knowledge and experience of staff at the ASC is the foundation of our success. Their efforts to build strong relationships with their colleagues and with individuals and organizations that participate in Alberta’s capital market are a critical part of the administration of provincial securities laws. We must continue to foster a strong sense of collaboration, including seeking input from market participants and encouraging a two-way flow of information.

Themes:

Engage stakeholders

Regular, timely and relevant engagement with all of our stakeholders is critical to effective administration of Alberta’s securities laws. Our priority is to enhance communications and increase two-way dialogue with stakeholders, addressing their needs and incorporating valuable feedback into future endeavours, as appropriate.

Enhance relationships with government and media

To promote efficient decision-making, alignment and timely implementation of broad policy objectives we will strive to have regular and meaningful communication between appropriate Government of Alberta officials and senior management.

In an effort to ensure our messages effectively reach and inform audiences, we continue to build relationships with media, and continually work to enhance our digital communications properties.

Staff engagement, retention, development and empowerment

We strive to ensure that employees have the right information, tools and resources to carry out their duties with proficiency, efficiency and consistency, and that projects and tasks that are pursued reflect strategic priorities. Additionally, we continue to provide a challenging and rewarding workplace that engages employees, promotes employee recognition and invests in employee growth and development.

Organizational development

By engaging with employees, we will investigate opportunities for ongoing enhancements to the organization and workplace to maximize our ability to meet strategic objectives and to achieve our vision to be a best-in-class regulator.

We are working to identify and assess technology that can improve the efficiency and effectiveness of regulatory and operational functions, while supporting hybrid collaboration and continuing to be vigilant about maintaining a high level of security for the ASC’s IT network and systems.